About Us

Building India’s Fintech Backbone

At Inditab, we are driven by the vision of building a financially inclusive India where access to essential services is simple and universal. By empowering businesses, agents, and entrepreneurs with ready-to-launch fintech solutions, we turn opportunities into growth for every partner and community we serve.

Our Plug & Play platform and APIs enable partners to offer a wide suite of services—credit cards & loans, recharges & bill payments, digital gold, savings accounts, gift cards, travel bookings, OTT subscriptions, and pay via credit card—all under their own brand. With strong compliance, security, and white-label flexibility, we make scaling fintech fast and effortless.

Together, we are making fintech simple, scalable, and accessible for every businesses.

Partners & Associations

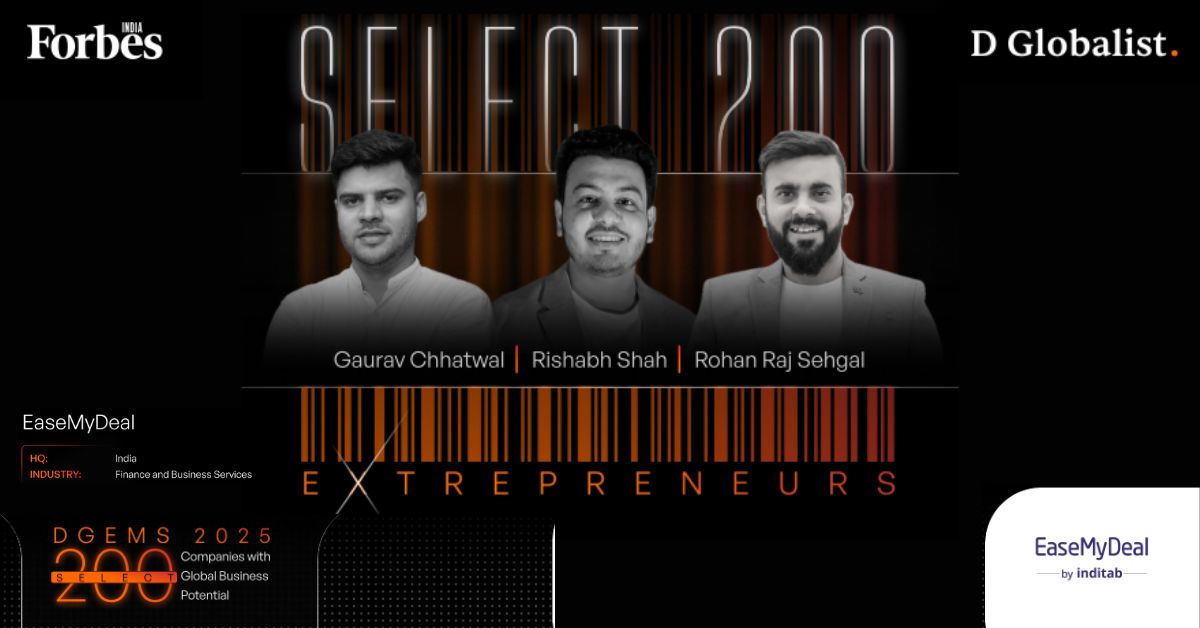

Our Team

Meet The Team

Gaurav Chhatwal

Founder & CEO

Rishabh Shah

Founder & CTO

Rohan Sehgal

Founder & COO

CA Rohan Kharbanda

Chief Financial Officer (CFO)

Chaman Singh

VP – Marketing

Ojaswee Singh

Manager – Strategic Alliances & Partnerships

Pankaj Tanwar

IT Product Head – EaseMyDeal

Sudhanshu Sharma

Inf. Marketing & PR Strategist

Ashwani

Head – Product Design & UI/ UX

Anjali Rawat

Head – Human Resource & Admin

Anamika Kapoor

Sr. Manager – Risk & Transaction Monitoring

Sunaina Bhartiya

Manager – Customer Experience

What our Number Speaks

GTV Processed

Customer Served

Fintech Partners

Our Vision

Our vision is to become a globally trusted fintech platform that simplifies access to financial products for businesses and users. We aim to expand internationally, offering credit card and loan engines, gift cards, and travel solutions with seamless technology. By building a scalable and transparent ecosystem, we want to empower businesses worldwide to deliver faster, smarter, and more accessible financial services.

Our Mission

Our mission is to build a fintech platform that helps fintechs, startups, and businesses scale faster through ready-to-use plug-and-play solutions. We handle technology, compliance, and integrations so our partners can focus on growth. With security, speed, and scalability at the core, we enable businesses to launch financial services effortlessly and expand into new markets with confidence and innovation.

Our Growth Story

Incorporated Inditab

Launched Pan Card and Deliver to NRIs, OCI & PIOs Outside India

Become Income Tax PSA

Launched Retail Network from Income Tax PSA in India

Retailers Onboarded: 5,000

Launched: Recharge & Bills, Flight, Hotel & Bus & Holiday Packages to Retailers

Retailers Onboarded: 10,000

Launched: GST, MSME, PAN Registration for Indian Customers

Retailers Onboarded: 12,000

Launched: EaseMyDeal Fintech App with Recharge & Bill Payment service

Reached Users: 1Mn

Retailers Onboarded: 15,000

Launched: Rent Payment on EaseMyDeal

Reached Users: 2.5Mn

Retailers Onboarded: 25,000

Launched: Gift Cards, Education Fees payments, Digi Gold, P2P Lending

Reached Users: 3.5Mn

Launched: Credit Cards, Loans & Credit Report on EaseMyDeal

Reached Users: 4.5Mn

Launched: Travel Booking, goVIP membership with 21+OTTs on EaseMyDeal

Our Events

Events & Updates

Certified. Compliant. Secure.

FAQs

Frequently Asked Questions

Inditab provides plug-and-play fintech solutions like Credit Card & Loan Engines, Recharges & Bill Payments, Gift Cards, Travel Bookings, and Digital Gold. Our ready-to-use APIs and platforms help businesses launch financial services quickly under their own brand.

Our products are designed for fintechs, startups, NBFCs, digital platforms, and enterprises that want to add financial services without heavy tech or compliance investment.

We provide end-to-end support including technology, compliance, customer care, and risk monitoring — so our partners can focus only on growth. Plus, our white-label flexibility ensures everything runs under your brand.

Yes. We are certified with PCI DSS, ISO, CIRCA, ASV, VAPT, and other leading compliance standards to ensure security and trust.

Currently, our operations are India-focused, but our vision is to expand internationally. We are building solutions like Credit Card & Loan Engines, Gift Cards, and Travel services that can be localized and scaled globally.

We have processed ₹7,250 Cr+ GTV, served 46 lakh+ customers, and work with 74+ fintech partners across the country.

Inditab is led by a team of seasoned founders and professionals across technology, finance, compliance, marketing, and operations, with decades of combined industry expertise.

Yes. Businesses can easily integrate our plug-and-play solutions to launch financial services instantly. To know more, visit our Contact Us page.