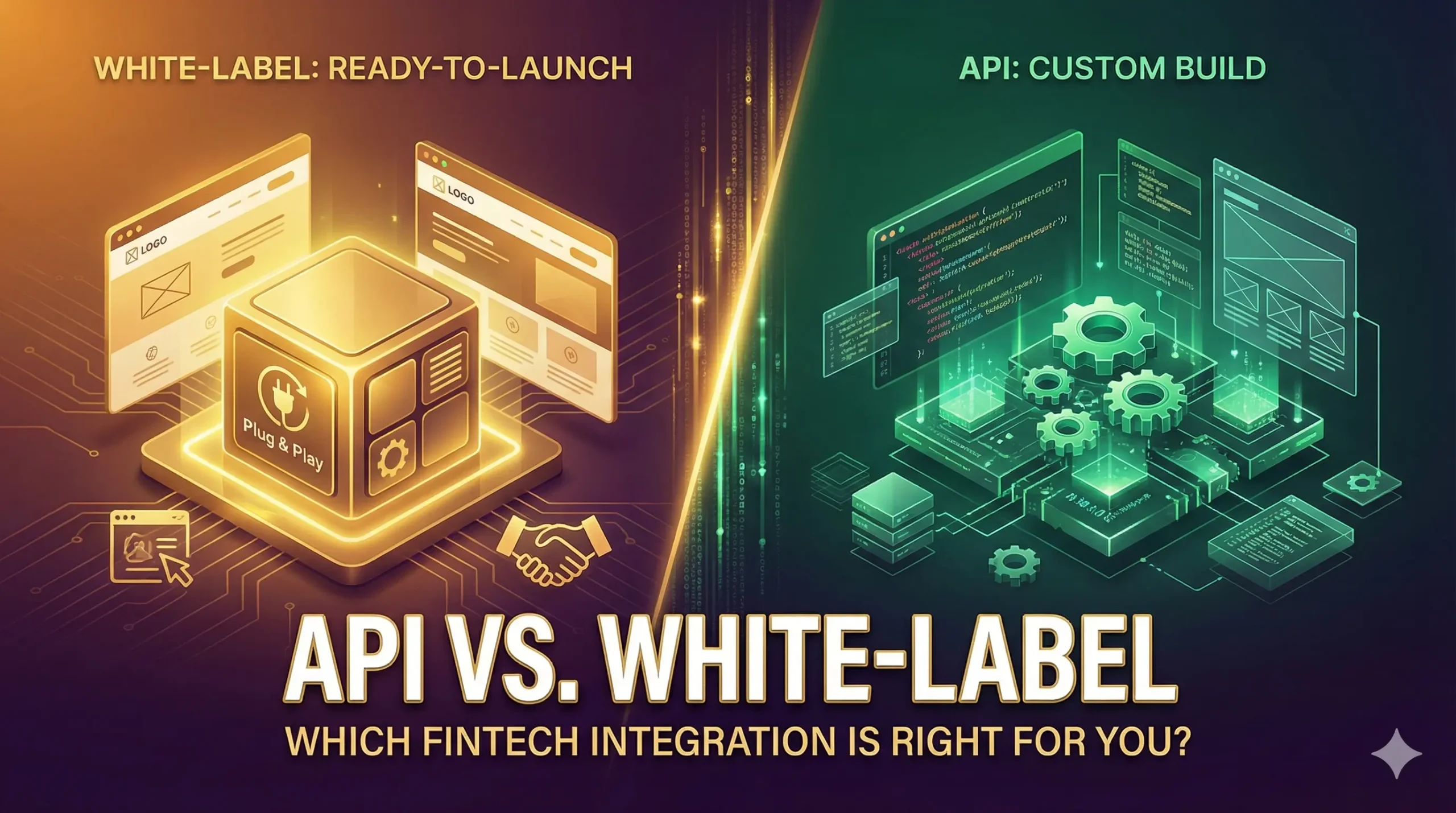

API vs. White-Label: Which Fintech Integration is Right for You

API vs. White-Label: Which Fintech Integration is Right for You

You have decided to add financial services to your business. Whether it’s offering credit cards, loans, or digital gold, the destination is clear: more revenue and better user retention.

But the path to get there often splits into two directions:

-

White-Label Solution: A ready-made, “plug-and-play” portal that you can brand as your own.

-

API Integration: A raw data pipe that connects financial services directly into your existing code and UI.

Choosing the wrong path can cost you months of development time or leave you with a product that doesn’t fit your brand. In this guide, we break down the pros, cons, and ideal use cases for both, so you can launch with confidence.

Option 1: The White-Label Solution (The “Fast Track”)

A White-label solution is a fully developed product built by a provider (like Inditab) that you can “rent” and rebrand. Think of it like moving into a furnished apartment—you just put your name on the door, and you are ready to live.

-

How it works: You get a pre-built website or portal. You simply upload your logo, choose your brand colors, and connect your domain.

-

Technical Requirement: Near Zero. You don’t need a coding team.

-

Time-to-Market: 24 to 72 Hours.

White-Label Solution is Best For:

-

Entrepreneurs & Agents: If you want to start a fintech business (like a loan distribution agency) but don’t have a tech team.

-

Speed-First Startups: When you need to validate a market idea this week, not next quarter.

-

Non-Tech Companies: HR firms, travel agencies, or consultants who want to cross-sell financial products without distraction.

Inditab Example: With our Plug & Play Whitelabel Suite, you can launch a full-fledged Credit Card & Loan portal under your brand in less than 3 days.

Option 2: The API Integration (The “Custom Builder”)

An API (Application Programming Interface) is a set of code that allows two software programs to talk to each other. Think of this like buying the raw materials (bricks, cement, wood) to build a house exactly the way you designed it.

-

How it works: Your developers write code to “call” Inditab’s services. We send the data (e.g., “List of Credit Cards”), and your app decides how to display it to the user.

-

Technical Requirement: High. You need a development team (frontend & backend).

-

Time-to-Market: 2 to 4 Weeks (depending on your team’s speed).

API Integration is Best For:

-

Established Apps: If you already have a mobile app (like an e-commerce store or expense tracker) and want financial features to feel “native” to your experience.

-

Custom UI Requirements: When you want full control over the font, button placement, and user flow.

-

Deep Integration: If you want to pre-fill loan applications using data you already have about the user.

Comparison: The Decision Matrix

| Feature | White-Label Solution | API Integration |

| Setup Time | Instant (1-3 Days) | Moderate (2-4 Weeks) |

| Tech Team Needed? | No | Yes |

| Customization | Low (Logo, Colors, Basic Theme) | High (Full UI/UX Control) |

| Maintenance | Managed by Provider (Inditab) | Managed by You |

| Cost | Lower Initial Investment | Higher Dev Cost (Salaries) |

| Best For | Speed & Simplicity | Control & User Experience |

Which One Should You Choose?

Choose White-Label IF:

-

You want to start generating revenue immediately.

-

You do not have a dedicated engineering team.

-

Your primary goal is marketing and sales, not building technology.

-

You are an offline business moving online for the first time.

Choose API IF:

-

You have an existing app or website with active users.

-

User Experience (UX) is your top priority and you want a seamless look.

-

You have developers who can maintain and update the code.

-

You want to mix data from multiple sources (e.g., showing a user’s credit score alongside loan offers).

Conclusion: You Don’t Have to Compromise

At Inditab, we understand that businesses evolve. Many of our partners start with a White-label Solution to test the market quickly. Once they reach a certain scale, they switch to our API Solutions for deeper integration.

The most important thing is to start. The fintech market is moving fast, and every day you spend debating technology is a day of lost revenue.

Need help deciding?

Talk to an Inditab Consultant today. We’ll look at your business model and tell you exactly which integration fits your goals.

Frequently Asked Questions

Absolutely. This is a common path. You can validate your business with our White-label portal and migrate to API integration once you are ready to build your own app.

Inditab’s pricing models are flexible. However, API integration implicitly costs more because you are paying your own developers to build the front end.