Enable Credit Card AI Engine

Enable a complete credit card marketplace on your app or website with our AI-powered plug-n-play engine. Get live in days with zero setup fee, all bank cards, advanced eligibility checks, and white-label branding — fully compliant and secure.

Zero Setup Cost

No upfront cost, no hidden charges. Start instantly with complete API access.

Instant Integration

Seamless API/SDK/URL integration to get your credit card & loan engine live within days.

KEY Features

What You Get with inditab

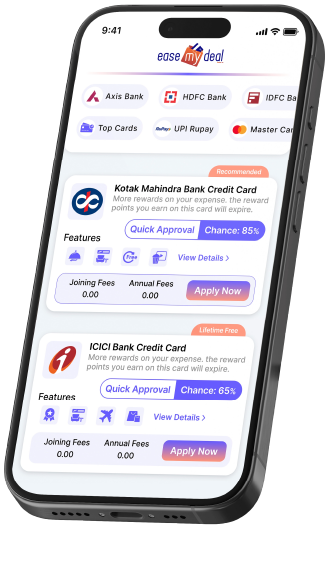

Give your users a complete credit card marketplace with smart filters, detailed info, instant apply — all under your brand.

Filters for Every Need

Travel, Rewards, Fuel, Shopping, Lounge, Lifetime Free & more.

Detailed Card Info

Joining/annual fee, approval chances, benefits, rewards, and offers shown.

Instant Apply Flow

Users can apply directly from your platform, boosting conversions.

Scalable & Global-Ready

Built to adapt for international banks and issuers.

USP's

Why Choose Credit Card AI Engine

All Bank Credit Cards in One Place

100+ cards from every leading bank, across all categories.

AI-Powered Eligibility Check

Show users their best matches with % approval chances.

Zero Setup & Instant Integration

Go live within days via plug-n-play API/SDK, with no hidden fees

Secure, Compliant & White-Label

PCI DSS certified, fully compliant, and customizable with your own branding.

Fully customizable for international markets.

One engine, endless global opportunities.

Adapt filters, eligibility algo. & branding for any country.

Support for local banks, issuers, and regulations.

International Scalability

Our Credit Card AI Engine is designed to scale globally.

- Built with international compliance standards.

- Maximize revenue across markets.

FAQs

Frequently Asked Questions

It’s a white-label, AI-driven marketplace engine you embed in your app or website so users can browse, filter, compare, and instantly apply for credit cards—all under your brand.

This is a B2B product. Fintechs, startups, banks, NBFCs, or any digital platform can integrate this to offer credit card discovery & application as a service to their users.

Users enter minimal required information; our AI algorithm then estimates an approval probability (%) and presents matching credit cards, helping users make better decisions before applying.

No. We charge zero setup fees. You only pay in relation to usage or per contract terms.

Thanks to the plug-and-play design (API / SDK / URL mode), most clients go live in 1–2 days, subject to compliance and onboarding checks.

Yes. You can fully brand it with your own logo, colors, layout, and UI styling so it looks like a native feature of your platform.

We integrate 100+ cards from leading banks across categories: rewards, travel, fuel, shopping, free & lounge access, etc.

No. This is strictly an application engine, not a payment gateway. Users apply for credit cards via the engine; no payment or fund transfer happens here.

Security and compliance are built-in. We handle PCI DSS compliance, regulatory requirements, data protection, and all relevant certifications so you don’t have to manage them.

Yes. The engine is internationally scalable. We adapt to local banking systems, issuers, and regulatory norms to make it viable in global markets.

You can integrate via:

- API (for regular status updated)

- Web SDK (for mobile apps)

- Hosted URL / widget (for lighter implementation)

- Affiliate Bank URLs (Create your own Engine)

You can monetize via successful card activations or based on mutually agreed business terms. The platform simply powers the flow; you own relationships and monetization.

We manage backend updates, bug fixes, compliance & regulatory changes. Your engineering team just needs to support the integration, UI, and occasional version upgrades.

Once a user applies via the engine, the issuing bank handles approval or rejection. You receive status updates via callbacks/webhooks/APIs, which you can relay to your user.

Reach out via our contact channel. We’ll walk you through product demos, documentation, compliance onboarding, and technical integration steps.