Enable Loan AI Engine

With our plug-and-play Loan AI Engine, app and website owners can instantly offer loans from 40+ banks & NBFCs — without building tech or lender tie-ups.

Zero Setup Cost

No upfront cost, no hidden charges. Start instantly with complete API access.

Instant Integration

Seamless API/SDK/URL integration to get your credit card & loan engine live within days.

KEY Features

What You Get with inditab

With our Loan AI Engine, you don’t just integrate technology — you unlock a complete loan marketplace under your brand.

40+ Banks & NBFCs

Pre-integrated lending partners, no direct tie-ups required.

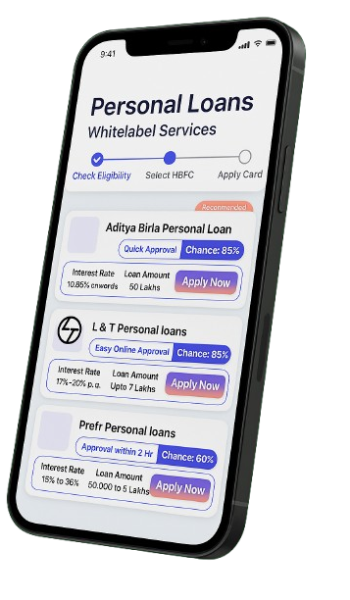

AI-Powered Eligibility

Smart engine shows users loans they are most likely to get approved for.

Loan Comparison

Users instantly see amount, interest rate, tenure & charges across lenders.

Revenue Dashboard

Track every lead, click, and disbursal to maximize earnings.

USP's

Why Choose Credit Card AI Engine

Plug & Play Integration

Go live in 2–5 days with simple API/iframe setup.

AI-Powered Loan

Show users their best matches with % approval chances.

No development cost, no infra investment.

Go live within days via plug-n-play API/SDK, with no hidden fees

End-to-End Support

From integration to compliance, we’ve got you covered.

Fully customizable for international markets

One engine, endless global opportunities.

Tailor eligibility, scoring, & loan categories

Support for all banks, issuers, and regulations

International Scalability

Our Loan AI Engine is not limited to India. We’ve built it to scale across global markets with easy localization.

- Built with international compliance standards.

- Maximize revenue across markets.

FAQs

Frequently Asked Questions

The Loan AI Engine is a white-label solution that lets you embed a smart, AI-powered loan marketplace into your app or website. Users can discover, compare, and apply for personal, business, or consumer loans—all under your brand.

This is a B2B offering. Fintechs, NBFCs, banks, digital platforms, startups, and apps can use it to offer loan products to their users without building everything from scratch.

Some core features include:

- Intelligent matching of users to suitable loan products

- Instant eligibility checks and approval probability scoring

- Comparison filters (interest rate, tenure, EMI, fees)

- Application handling via API or UI

- Dashboard & insights for loan leads

- Risk / underwriting module support

- Webhooks / callbacks/ APIs for status updates

Users provide minimal information (name, dob, pan, phone no., income,, etc.). The AI module predicts the likelihood of approval and suggests loan offers accordingly, helping reduce drop-offs in the application process.

No. We do not take upfront setup or maintenance charges. You pay only based on usage as per the contract.

Because the solution is plug-and-play (API / SDK / URL / widget), clients often go live in 1 to 2 days, subject to compliance and onboarding requirements.

Yes. The engine is designed to be fully rebranded. You control logo, colors, fonts, UI layout — so the experience feels native to your platform.

We support many loan types:

- Personal loans

- Business / SME loans

No. The engine is strictly for discovery, eligibility, and application. Loan disbursements, fund flows, and servicing are handled by our partner banks or NBFCs.

We build in compliance with applicable regulations (e.g. KYC, anti-money laundering, data protection). Our infrastructure is secure, encrypted, and audited. We aim to make you compliant “out of the box.”

Revenue models is very clear. You can monetized on the basis of per successful loan disbursal.

We continuously maintain backend services, update for regulatory shifts, and roll out improvements. You’re responsible for the UI integration, and upgrading to new versions when needed.

Once the user submits the application, the partner lender (bank / NBFC) processes it. You receive status updates (e.g. pending, approved, rejected) via webhooks or APIs, which you can forward to users.

You’ll get dashboards and reports with metrics like:

- Number of leads / applications

- Approval rates

- Pipeline status

- Conversion funnel

- Performance by loan category

These insights help optimize and scale your offering.

Simply contact us via inquiry or email. We’ll guide you through:

- Demo & product walkthrough

- Compliance & KYC onboarding

- Technical integration (API, SDK, widget)

- Testing & sandbox mode

- Go-live